News and Events

February 13, 2008

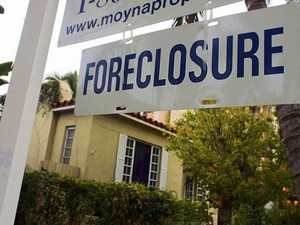

Need Help Avoiding Foreclosure?

(ARA) - Are you having

trouble keeping up with your mortgage payments? Have you received a notice from

your lender asking you to contact them? If so, you may be in danger of losing your home to foreclosure, something you want

to avoid at all costs.

Foreclosure has all kinds of negative repercussions. Not only do you have the

emotional upheaval caused by losing your home, but the stress of having to find

another place to live, and then you have to deal with the harsh reality of the

financial implications.

These include the possibility of losing the appreciated value of your home and

the equity you have in it; the destruction of your credit report; and the risk

of jeopardizing future employment opportunities as many employers now run

credit reports on potential employees before hiring. But the good news is there

are steps you can take to keep this from happening.

Among the options you have…

* Converting adjustable-rate loans to low, fixed rate loans;

* Getting a 10-year loan extension, which allows you to bring the monthly

payment down;

* Obtaining a permanent interest rate reduction to lower payments.

How do you know which option will work best for you and how to implement it? By

turning to a pre-foreclosure advisor for help. If you don't feel comfortable

talking to your lender, log on to www.ehomeassure.com

and make an appointment with an independent counselor who will review your

financial situation to determine which options are available to you.

Remember, time is of the essence. The sooner you get to work, the more options

you'll have available to you.

Copyright © 2007, ARAnet, Inc.